Germany’s political system and social cohesion are at stake unless it restricts Chinese wind turbines in the country, a government-backed analysis seen by POLITICO warns.

The report, which the German defense ministry commissioned, argues Beijing could purposefully delay projects, harvest sensitive data and remotely shut down turbines if given access to wind farms. It also advises the country to stop an existing wind project using Chinese turbines from going ahead.

“When using systems or components from Chinese manufacturers … given the political situation, it can even be assumed that such a slowdown or even disruption would be deliberately used by China as a means of political pressure or even as an instrument of economic warfare,” reads the report, prepared last month by the German Institute for Defense and Strategic Studies think tank.

“A destabilization of both the political system, the business model of German industry and social cohesion cannot therefore be ruled out due to a lack of or insufficient planning security in the energy sector,” it adds.

The analysis comes amid growing concerns related to critical infrastructure risks in Europe. Since 2022, at least six separate incidents of suspected underwater sabotage have taken place in the Baltic Sea.

Meanwhile, Brussels has begun cracking down on Chinese wind suppliers after suspecting them of receiving state subsidies to beat out European competitors for European Union projects. Last year, the European Commission, the EU’s executive, opened a probe into Beijing-linked wind projects in Bulgaria, France, Greece, Romania and Spain.

Now those risks are likely to increase if ties worsen with Beijing, according to Andrea Scassola, vice president of wind research at the Rystad consultancy.

“What we are seeing … is intensifying great power rivalry, and at a time when our world is more interconnected than it has ever been — it’s a magnifier of vulnerability and risks,” he said.

Overdependence on China also raises the risk of cyberattacks that could “lead to a shutdown of production,” Scassola said, adding that similar public warnings or legal moves to restrict Beijing’s access have already taken place in the Netherlands, the United Kingdom, Poland and Lithuania.

The report makes similar warnings. If relations sour with China, Beijing could delay the operation of new farms by “at least four to five years” between the planning approval and commissioning stages, the analysis reads, and could coordinate other disruptive efforts with Russia.

Part of the danger also comes from the access that manufacturers get to turbines, according to the study. Beijing’s suppliers would have access to computer programs that control active turbines and collect data from hundreds of radars built into farms, it states — a significant issue given that wind produced a third of Germany’s electricity last year and a fifth of the EU’s power.

In sum, the report argues, that would hand China “considerable blackmail potential in the future.”

Germany’s defense ministry and the German Institute for Defense and Strategic Studies declined to comment on the report.

Public safety issue

Despite the warnings, Germany has already begun eyeing Chinese firms as potential suppliers.

Last year, project developer Luxcara announced it had selected Beijing’s Ming Yang Smart Energy to supply 16 turbines for its “Waterkant” offshore wind farm in northwest Germany.

The report warns that the “first time use of Chinese wind turbines must be prevented” on “public safety” grounds, since it risks creating a reliance on Beijing’s expertise and giving it access to “essential elements of German critical infrastructure” near militarily relevant training areas.

That’s not the first time the Chinese manufacturing giant’s overtures to Europe have come under scrutiny. Ming Yang supplied 10 turbines for an offshore wind farm in southern Italy that was completed in 2022; Britain’s investment minister also met with the company in December to discuss its business prospects in the U.K., POLITICO revealed last week.

Germany’s wind industry is wary of the Waterkant project, too. Local turbine makers see projects with Beijing’s products as a “massive risk,” said Karina Würtz, managing director of the German Offshore Wind Energy Foundation, while acknowledging that projects like Waterkant face “threats to [their] commercial viability” if Chinese suppliers withdraw.

Berlin must now “investigate into that risk, honestly and in-depth,” she said, and push ahead with enforcing EU laws like the 2023 NIS2 directive, which includes measures to mitigate cybersecurity threats, as soon as a new government is formed after the Feb. 23 election.

The report, meanwhile, suggests that Berlin explore legal tools like its national procurement law and Wind Energy at Sea Act to exclude Chinese firms from contracts on defense or public safety grounds.

Ming Yang did not respond to questions sent by POLITICO. Luxcara declined to comment./Politico/

State Honours in Belgrade for a War Criminal

State Honours in Belgrade for a War Criminal  Ukraine and Sweden sign a long-term deal for up to 150 Gripen fighter jets for Kyiv

Ukraine and Sweden sign a long-term deal for up to 150 Gripen fighter jets for Kyiv  European Parliament draft resolution on Serbia supports citizens’ right to protest

European Parliament draft resolution on Serbia supports citizens’ right to protest  Poland detains eight over suspected Russia-linked sabotage, says PM Tusk

Poland detains eight over suspected Russia-linked sabotage, says PM Tusk  No Trump-Putin meeting in foreseeable future — this is why

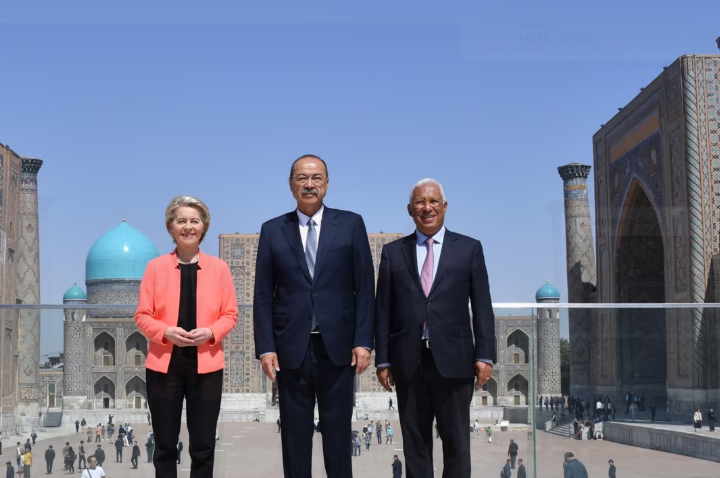

No Trump-Putin meeting in foreseeable future — this is why  EU Readies New Trade Routes — And A Challenge To Beijing And Moscow — At Luxembourg Summit

EU Readies New Trade Routes — And A Challenge To Beijing And Moscow — At Luxembourg Summit